Portland, OR Feb 1, 2024 – A Foureyes study of approximately 700 U.S. automotive dealerships establishes lead-to-sale benchmark data for new and used inventory during the second half of 2023.

Identified in the study were the average conversion rates from internet and phone opportunities for four specific metric categories: contact rate, appointment set rate, appointment show rate, and appointment close rate.

“We’re excited to share this data with dealers and help them see how the industry is performing around them,” said Foureyes CEO, David Steinberg. “As inventory supply, demand, and many other factors continue to return to a new normal, our hope is this benchmark data helps quantify and validate the pressure dealers have begun to feel once again.”

For new vehicle inventory, aggregate phone ups and internet leads had a 41% show-to-sale rate, while used vehicles saw a 40% show-to-sale rate across the same two sources.

Looking at the source type for new vehicles, show-to-sale rates from internet leads (42%) slightly outperformed the same metric for phone ups (40%). Conversely, used vehicles had a higher conversion rate from phone ups (42%) compared to internet leads (39%).

The comprehensive data set across all category segments identified in the report is as follows:

New Vehicle Inventory Conversion Rates by Source

NEW VEHICLES | Contact Rate | Appointment Set Rate | Appointment Show Rate | Appointment Close Rate |

Internet leads | 60% | 32% | 56% | 42% |

Phone ups | 73% | 73% | 62% | 40% |

Internet + Phone | 63% | 42% | 58% | 41% |

Used Vehicle Inventory Conversion Rate By Source

USED VEHICLES | Contact Rate | Appointment Set Rate | Appointment Show Rate | Appointment Close Rate |

Internet leads | 64% | 41% | 50% | 40% |

Phone ups | 79% | 81% | 63% | 42% |

Internet + Phone | 67% | 48% | 54% | 40% |

*Benchmark Categories Defined:

- Contact Rate: Opportunities indicating a dealer established two-way communication with prospect for the first time during this timeframe, divided by total leads in same timeframe

- Appointment Set Rate: Appointments with scheduled dates during this timeframe on open opportunities, divided by contacted leads in the same timeframe

- Appointment Show Rate: Appointments that have a scheduled date during this timeframe, divided by total appointments set in same timeframe

- Appointment Close Rate: Sales during this timeframe from a prospect with a logged “Shown” appointment, divided by total appointment shows in same timeframe

This data represents the first Foureyes study to benchmark these specific lead-to-sale conversion rate categories.

Inventory (and Competition) Once Again

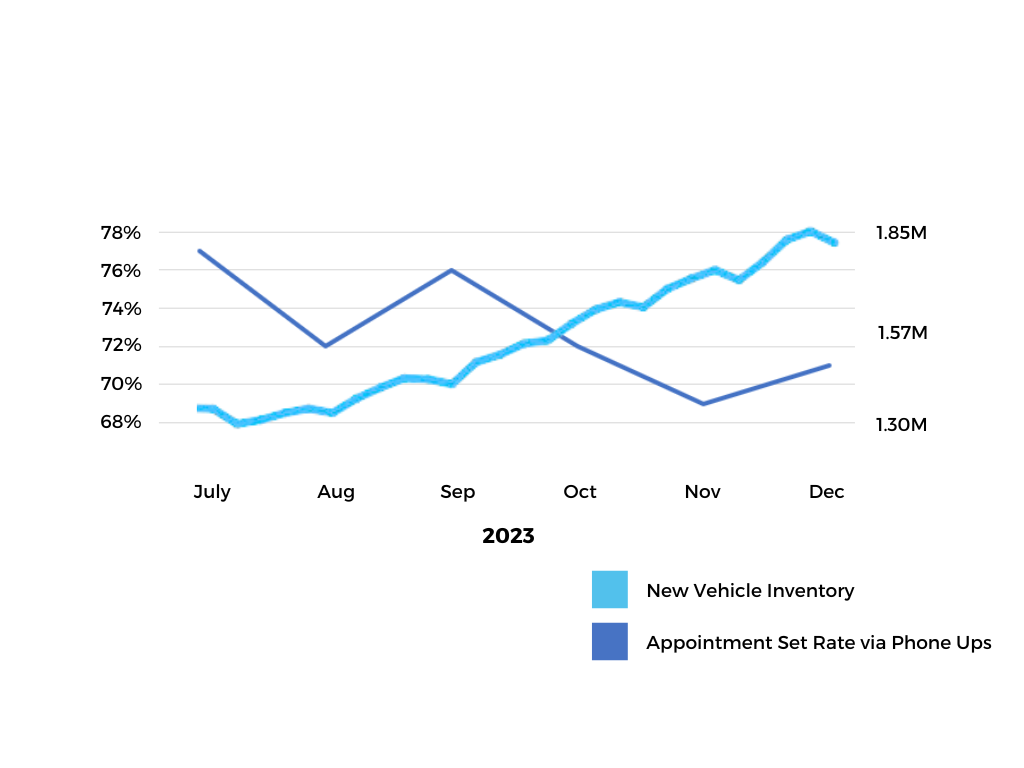

While most of the data in the study remained steady over this time period, one trendline stood out above others.

Over the final six months, and particularly between Q3 and Q4, there was decline in new vehicle appointment set rates specifically from phone ups. This rate was 77% in July but ultimately dipped to 71% by December – with the Q4 averages generally lower than Q3 average. Notably, the decline coincided with a 23% growth in new vehicle inventory during the same span.

U.S. New Vehicle Inventory Availability vs New Vehicle Appointment Set Rate via Phone Ups

“There are plenty of factors in play across the industry, but this really quantifies what our dealers are seeing and hearing – that car selling feels harder now than it has in a few years," said Steinberg. "Dealers who are winning right now are the ones getting into the details of their sales process and making adjustments."

About Foureyes

Foureyes is an automotive data platform with sales enablement applications that help dealers convert more leads to sales by automatically engaging active shoppers with personalized content, alerting your sales team when active shoppers return to your site, and by capturing every website lead – specifically the ones dealers otherwise would have missed.

Matt Inda, Foureyes, http://www.foureyes.io, 1 971-352-3494, [email protected]