When I talk about the state of data in the auto industry, I'm reminded of Moneyball.

Yes, I’m talking about the 2003 book turned Brad Pitt film chronicling the story of Oakland A’s general manager Billy Beane.

As the story goes, Beane manages the team through a difficult loss, and the team is losing star players. The A’s budget is limited, and rebuilding the team seems unattainable. Facing these challenges, Beane meets Yale economics grad Peter Brand. Brand has new ideas about how to evaluate players and uses the data available to better predict a player’s chances of success.

The rest is a storybook ending. Brand joins as the assistant general manager, and soon he and Beane are using data and their new methodology to find the undervalued players, and the A’s go on to win the American League West title.

What Does This Have to Do With Automotive Data?

Moneyball is one of the first widely-viewed examples of data as an opportunity. This opportunity is much larger than baseball or any one industry and has become an assumed fundamental business belief. If you can figure out how to use your data, you have an advantage.

Prior to the 2000s, data was expensive. As it became cheaper to store data, businesses were told to collect everything, and so we all started to hoard it. Like a stack of newspapers from 1998, we didn’t know why we needed it, but we wanted to keep it just in case.

This shift takes us to today, where we spend an unbelievable amount of time and money on data. We continue to collect immense amounts of data. And by collecting so much data from so many different sources, we’ve created the problems that we’re now trying to fix. Worse yet, we still can’t answer the basic questions.

Why Automotive Data Is Especially Tricky

While these challenges are true for all industries, there are three key reasons why using and analyzing data is particularly challenging for the automotive industry.

- Auto is federated. Dealers have some autonomy but still must report up to the dealer group and OEM. So while the freedom to make those decisions can be a distinct benefit, it also means that two dealers within a group could have different CRMs, marketing strategies, tech stacks, and sales processes. This poses a challenge when groups want to analyze success.

- Auto is legislated. It’s true that the automotive industry is heavily regulated–you only need to take a look at the news to see how quickly the rules change. But vendors use the changing legislation as an excuse to separate dealers from their data. They deny access with the excuse that they’re only protecting dealers. This is not a means of protection, and there is no reason you shouldn’t have access to your own data.

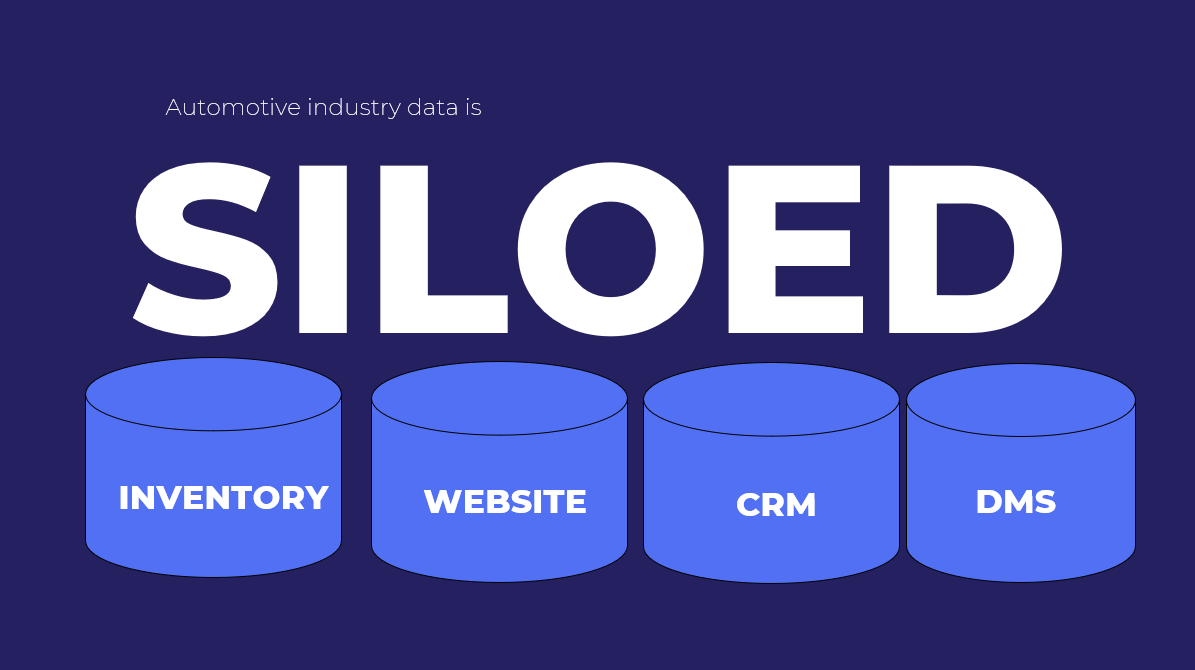

- Auto is siloed. Right now, any given dealer has data from these four systems: inventory, website, CRM, and DMS. They don’t talk to each other well, making full-picture data analysis challenging.

Considerations to Get the Most From Your Data

Improving automotive data is complicated and will only happen through collaboration between all parties, from vendor to dealer. Here are the guardrails that we believe can make meaningful change happen:

- Own your expertise. Vendors are helpful and necessary for data visualization and collection, but they don’t have the skills and insight you have into your own business. I like to say that good data doesn’t give you the answers, it helps you ask better questions. You have to combine good data with your context to get real answers. We can help you measure walk-in traffic, but only you know that there’s been a construction project for the last two weeks that’s affecting your traffic.

- Demand more from your silos. Everything you put into a system should be able to be extracted. If that’s not the case, your vendor is basically saying that they own YOUR data.

- Question the black box. If a vendor is unable to explain to you how they provide the numbers or answers that they have, then it is too good to be true. Everyone wants to deliver the answers, but not everyone can back up those answers with methodology and technical authority.

“If I was so good at selling cars, I would actually probably start my own dealership.”

- Me (David Steinberg, Foureyes Founder & CEO)

What’s Our Answer?

Foureyes views these challenges as an opportunity for auto groups. We’re not satisfied seeing these issues and ignoring them, which is why we built a tool that directly addresses these hurdles.

Our answer is the Unified Data Platform (UDP). The UDP unlocks the mountain of data you and your dealers are sitting on today – across website, inventory, and CRM data – and compiles it into a single dashboard so you can better report, optimize, manage, and make more informed marketing and sales decisions within and across rooftops. You can use it to import and own your data while also having access to pre-built and customizable reports. Combined with your context, the UDP enables you to tackle the questions that drive businesses today, like:

- Where are we getting leads from?

- How are we closing our leads?

Our latest offering is also our most ambitious, which makes it all the more exciting to share, and we even have a sneak peek into the tool below. If you or your group is interested in accessing the data needed to fuel those better questions, contact us today.