The irony isn’t lost on us marketers: We have more data and tools than ever before, yet we’re still unable to answer simple questions of marketing performance. Questions like:

- “How many good leads did we have this month?”

- “Which sources drive our best leads?”

- Or my personal favorite, “You say we had 200 leads and the sales manager said we have 10 prospects. Where are the other 190?”

To understand this situation (and defend marketers just a bit here), let me provide some background. On average, small businesses (under 20 employees) use 13 martech tools and mid-size businesses (21-500 employees) use 27. And almost every one of these tools operates on different definitions of what a “lead” is.

Why exactly is this? The short answer is because distinguishing a sales lead is complex--and most marketing tools don’t even attempt to do it. Let me explain further.

Data Issues That Prevent Marketers From Seeing the Full Picture

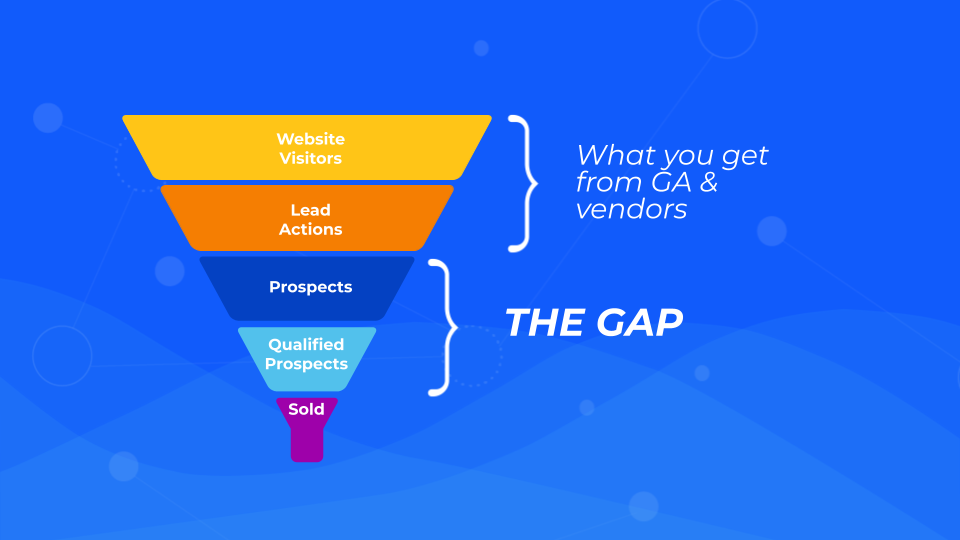

Every dealership has its own unique funnel stages. But most are likely going to be some variation of these basic stages:

- Visitors: The people on your website regardless of buying intent.

- Leads: The people who have shown interest by taking an action such as having called, filled out a form, or chatted online with your dealership.

- Lead action: The event, such as a form fill or call, that shows buying intent.

- Qualified prospects: The subset of leads who are confirmed to be interested in purchasing from you; service and other non-sales leads are excluded from this group.

- Sold leads: The people who completed the sales process and purchased a vehicle from your dealership.

Analyzing the Gap

- Most vendors, including Google Analytics, stay at the website visitor and lead action level of the funnel, meaning you only see counts of actions. In the context of sales, a lead is a single individual. In the context of marketing data, a lead is a lead action--and a single individual may take numerous actions. Foureyes data shows that the average person submits 1.3 lead actions, which means your pipeline is inflated when you (or your vendors) count every action as an individual lead. This leaves marketers talking in numbers instead of names, and unable to distinguish solicitors or competitors from true prospects.

- “Leads” aren’t the same as qualified prospects. Software that does help get from lead action down to prospects usually focuses on uniqueness--not quality. This is another major challenge, as Foureyes data shows that only 45.6% of automotive leads are qualified prospects. This causes a couple of issues. First, your reports are inflated with leads that have no chance of becoming sales, like bots. Second, your conversion data is inaccurate. You can’t accurately judge marketing or sales success when your foundational number of leads is wrong.

- Reporting lags behind the opportunity. The sales cycle moves quickly (the majority of sold leads in automotive close in three days), and the data doesn’t keep up. If marketing reporting happens on a monthly basis, the data can feel too old to be relevant in a fast-moving environment.

- Source data is often flawed. Most automotive dealerships use the CRM as the source of truth, yet many leads will be labeled “web leads.” Is that actually an organic lead? A paid lead? Data like this makes evaluating lead sources (and campaigns and budgets) difficult, if not impossible.

Getting Data to Work for You

At Foureyes, we understood the business pain created by classic marketing reporting and that’s why we created Foureyes Omni-Tracking. We knew you didn’t need one more dashboard, but you did need a tool that connects website tracking to sales performance. That’s why Omni-Tracking gives you a clear pipeline view, from website visitor → lead action → unique prospects → qualified prospects → sold.

Additionally, it gives you visibility into your quality leads (actual names that sales should recognize) so you can translate your marketing metrics to sales opportunities. It empowers marketers with the data to tackle questions about performance and answer effectively.

Omni-Tracking is able to do this because it analyzes leads for buying intent using a combination of AI and human analysts. This means you see sales-ready leads instead of the junk (e.g. service requests, spam, vendors tests).

If you’re finding that marketing and sales data never line up, or you just want better business answers from your team, get a demo today. It’s fast and painless, and the quickest path I’ve seen to start having better business conversations from marketing data.