“What can I cut?”

That was the first thing my client John said on our recent business review call.

He had one thing on his mind: his lead sources - i.e. the tools and vendors sending leads to your website or CRM. While they all reported positive ROI, he didn’t feel confident that his money was being spent to the best of its ability. And while he came to the call with some suspicions on what would be the best to cut, he wanted more than gut feelings.

Foureyes data is objective. In fact, it’s not “Foureyes data” at all. It’s actually your data that we’re helping you collect, connect, and analyze. So we have no skin in the lead source game–and I wanted to do everything I could to help him make this decision, especially because it’s not always easy to know which vendors are truly helping you.

My client John wanted what many dealership leaders want: a clear understanding of which of his vendors was worth his money. To answer that, here’s what we discussed.

1. What results are you getting AND do you trust them?

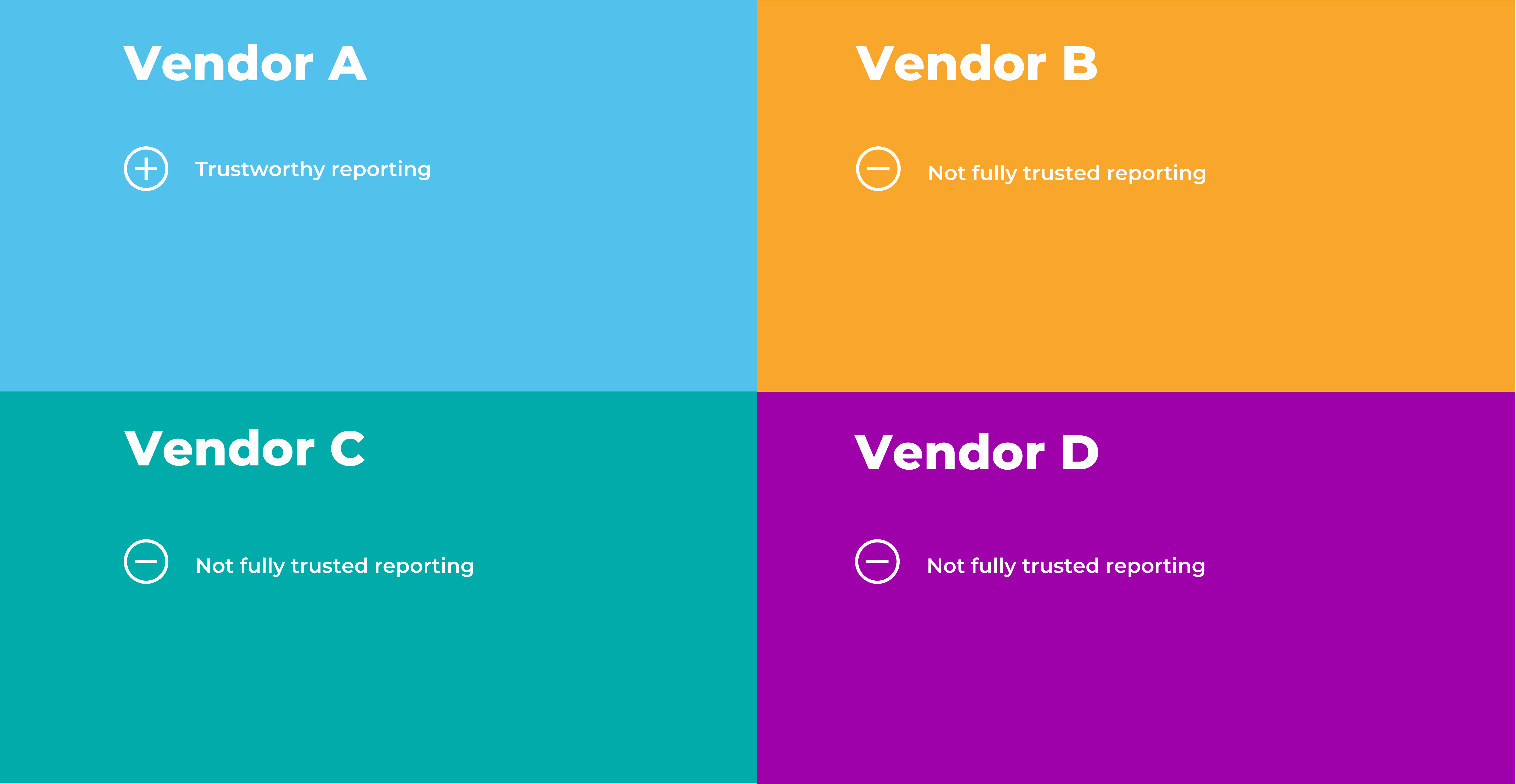

We had to first start with some foundational information: who’s on the list, what do you pay them, and what have the results shown.

John came prepared with exactly how much he was spending for each of his four main lead vendors, including details on the sales that they drove (if he could easily access them).

By talking through each vendor and their results, John quickly decided one wasn’t on the chopping block. Why? He trusts their reporting. They show him more than just VDP views, and he doesn’t have to do any summersaults in Google Analytics to see the vehicles they helped him sell.

Letting this vendor off the hook speaks to his main concern–he wants to objectively show who is making the best use of his money. He’d rather keep a vendor with excellent reporting and good results than excellent results and subpar reporting.

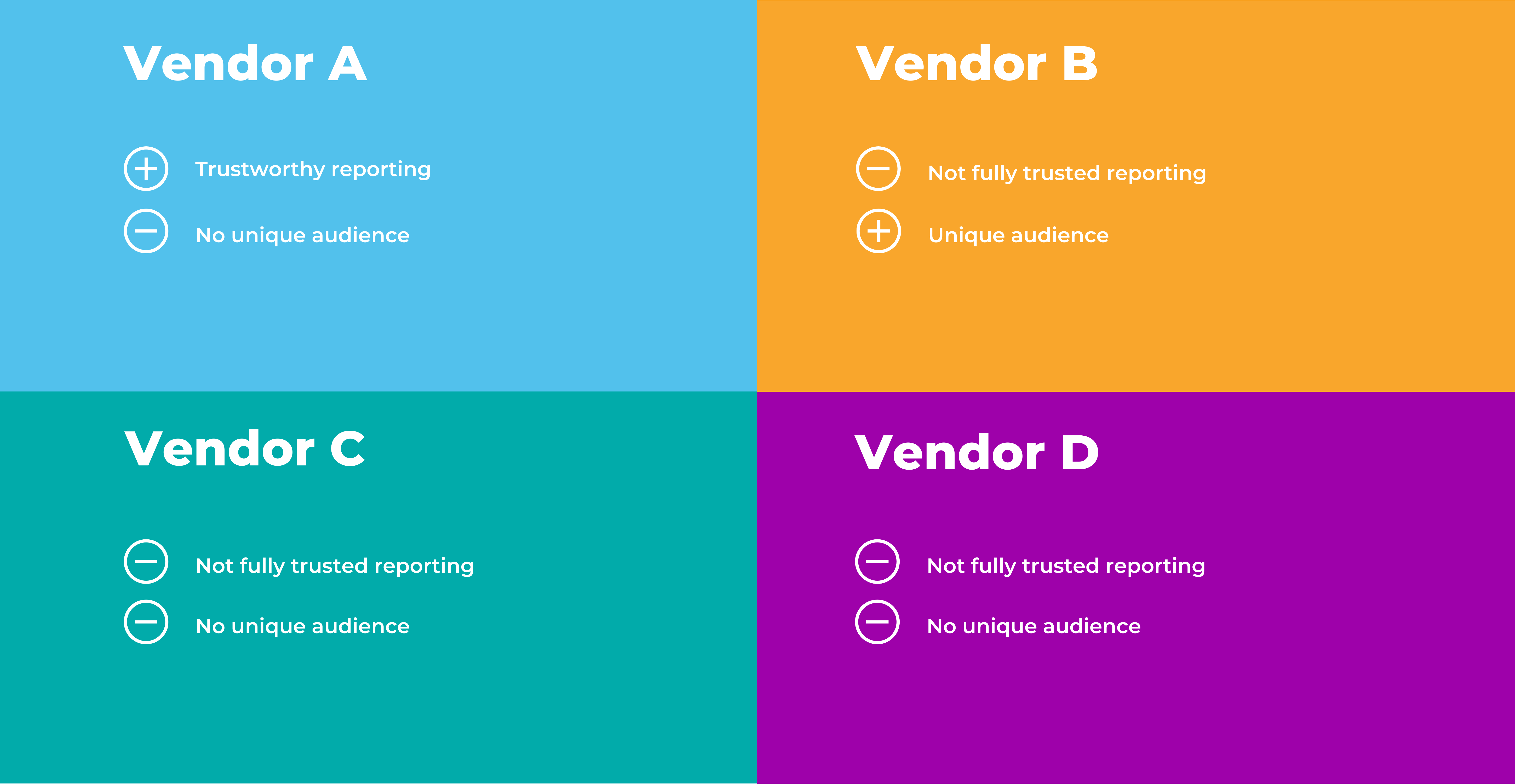

2. Why did you start using each vendor in the first place?

Next, we wanted to identify any benefits outside of strict ROI that the vendor offered. Are there any audiences that this vendor has exclusive access to? Do you use this vendor to fill the top of the funnel or get new sales or build general branding?

John was especially worried about doing things because “everyone else is.” Auto is a small world, and whether it’s a social media trend or new lead vendor, it’s easy to feel like you’re missing out on something if you don’t hop on the bandwagon. That said, he didn’t want that to be the reason he stuck with an underperforming vendor.

Of his vendors, John said only one had an audience that wasn’t anywhere else. Bingo. They get to stay.

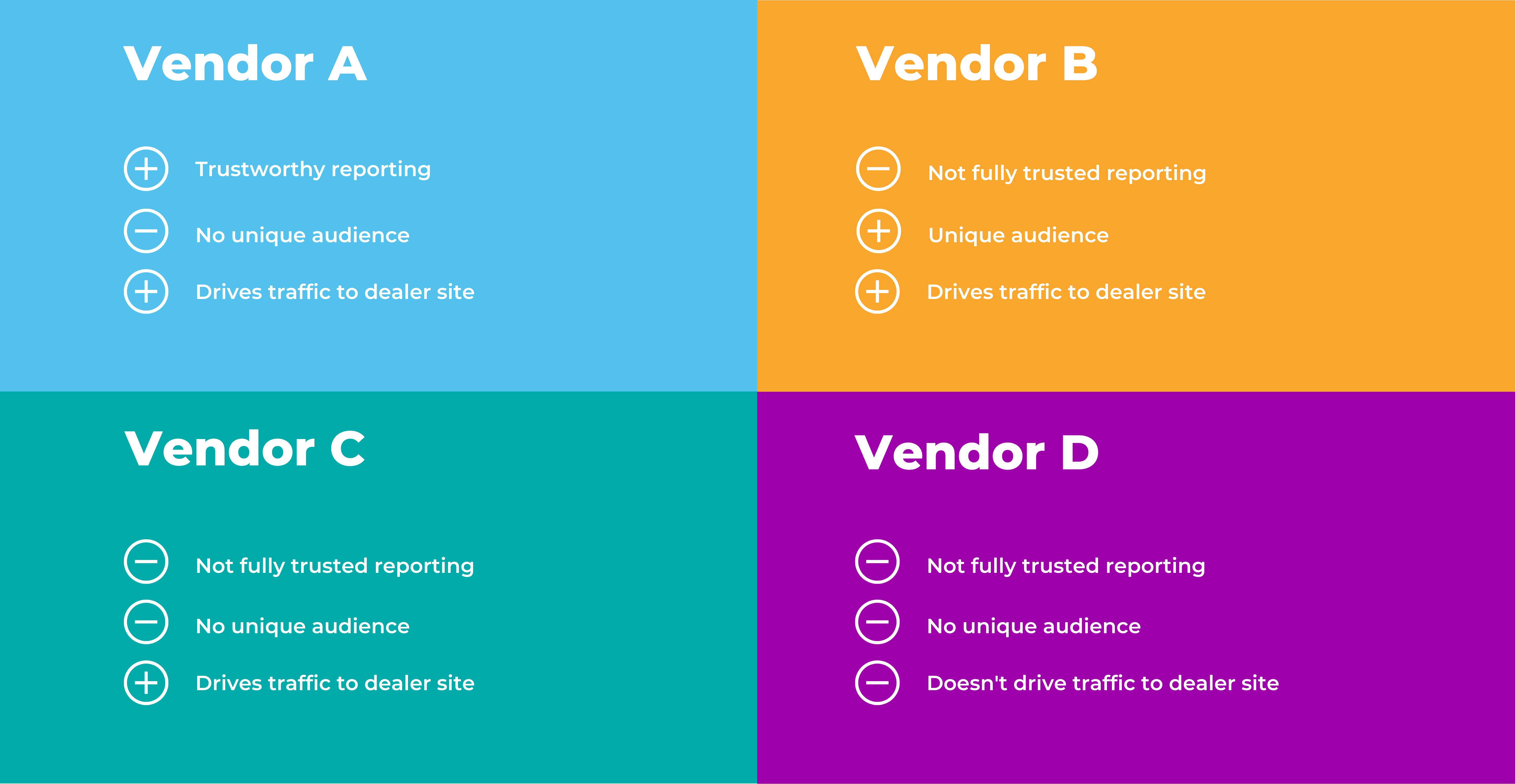

3. What’s the vendor’s end goal for the lead?

With two vendors already off the hook, John wanted to be sure that he knew exactly what each vendor was being paid to do. (Candidly, a lot of GMs can’t fully answer this for all of their lead vendors.)

Some vendors direct leads to your website, while others try to keep leads on their site while sending lead info directly into your CRM.

It’s important for you to understand how each vendor is approaching the lead process so that you can accurately judge performance. Can you see success outside of the vendor’s own platform? For example, if the vendor directs traffic to your site, then that will be reflected in GA or another analytics tool.

Understanding the metrics each vendor prioritizes will also help you see any gaps in reporting. Vendors will naturally show you the metrics that make them look the best, but these might not be the ones YOU want to prioritize.

John didn’t love that one of his vendors reported on visits to their site, not his. He wasn’t ready to cut them based on this alone, but it was a consideration.

Can you spend the money any better?

Again, John came in with positive ROI for all of his vendors. Yet, he still wasn’t convinced that they were worth the money. How can that be? After all, doesn’t getting 3x for the money sound great??

Everyone will show you good ROI (let’s at least hope), but you might not get real clarity on how a vendor got to those numbers. And beyond transparency (which every vendor should strive for), your vendors should be proactive partners in your success. When the market changes or your business goals evolve, your vendors should be right alongside you, finding new solutions and opportunities.

But smart dealership leaders like John know that covering the cost is the bare minimum. Vendors like to say that they “pay for themselves,” but what else could that same budget do somewhere else? John was ready to reallocate any budget that could be doing more for him.

This is the hardest question to answer because while you can look to past results, you’re dealing with hypotheticals. It’s impossible to say for sure what you could have done had you spent your money differently. But you can consider different possible scenarios for what you would win or lose by changing up your mix.

Making Tough Calls

By the end of our discussion, John decided to cut one of his third-party vendors. The weakest link? Vendor D.

This vendor hangs their hat on views on the vendor site, not John’s, and while the reporting dashboard shows that John grossed $13k last month, he couldn’t independently back that up. He had initially felt tied to the vendor because “everyone” uses them, but they didn’t have a unique audience or other purpose for his business.

These certainly aren’t the only questions to ask when considering changes to your vendor lineup, but they are all good thought starters for a healthy discussion on how your vendors are spending your money. You deserve objective answers and transparent reporting on results.

Otherwise, it may be time for a chop.